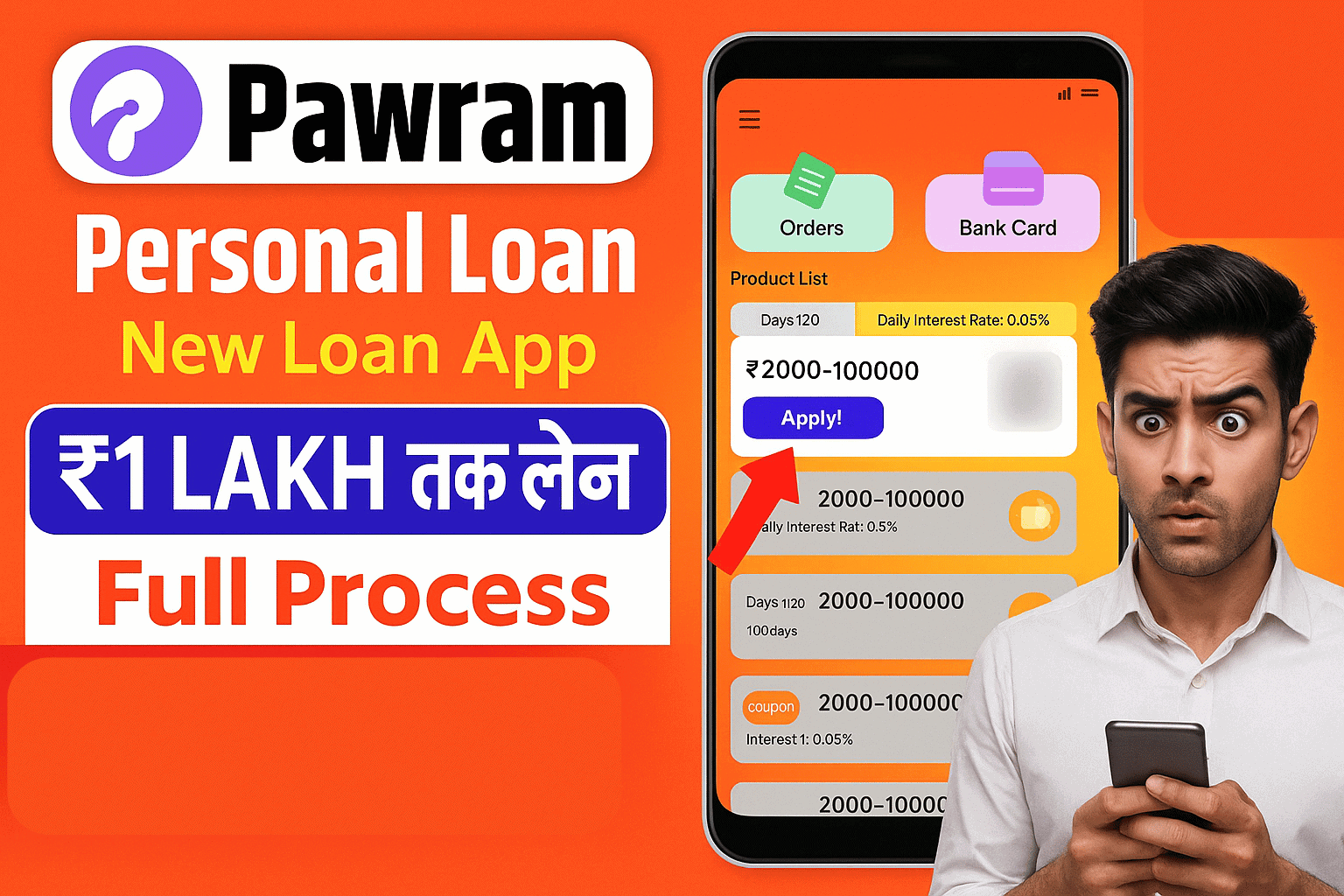

Ever found yourself in a sudden cash crunch with no one to turn to? Whether it’s an unexpected medical bill or a short-term emergency, we’ve all been there. Thankfully, the Pawram Loan App offers a simple, fast, and secure way to get personal loans directly into your bank account—within minutes!

In this guide, we’ll walk you through how to take a loan from the Pawram Loan App step-by-step, with tips and best practices to boost your approval chances. Let’s dive in!

What is the Pawram Loan App?

The Pawram Loan App is a fintech solution designed to provide quick, paperless, and unsecured personal loans to individuals in India. Whether you’re a salaried employee or self-employed, Pawram aims to make borrowing hassle-free using just your smartphone.

Key Features:

- Instant loan disbursal within minutes

- Loan amounts ranging from ₹5,000 to ₹1,00,000

- Minimal documentation required

- 100% digital process

- Flexible repayment tenure (3 to 24 months)

Step-by-Step: How to Take a Loan from Pawram Loan App

1. Download and Install the App

- Visit the Google Play Store

- Search for “Pawram Loan App”

- Tap Install and wait for the app to download

2. Register and Create Your Account

- Open the app

- Enter your mobile number and verify with OTP

- Create a secure 4-digit PIN

3. Complete Your Profile

- Fill in personal details: name, date of birth, PAN number, and address

- Upload a clear selfie (for KYC verification)

4. Add Employment and Income Details

- Select your profession: Salaried or Self-employed

- Provide employer/business name and monthly income

- Upload salary slips or bank statement (last 3 months)

5. Check Loan Eligibility

The app will automatically show your eligible loan amount based on your credit profile, income, and past borrowing history.

6. Choose Loan Amount and Tenure

- Select how much you want to borrow

- Pick a suitable repayment duration (e.g., 6, 12, or 24 months)

- Review interest rate, EMI, and processing fees

7. E-sign the Agreement

- Read and accept the digital loan agreement

- E-sign using Aadhaar-based OTP authentication

8. Receive Funds in Your Bank Account

Once verified, the approved loan amount is transferred instantly to your bank account. You’ll also receive an SMS and email confirmation.

Who Can Apply for a Loan on Pawram App?

- Indian resident (18 to 60 years old)

- Must have a valid PAN & Aadhaar card

- Minimum monthly income: ₹10,000

- Stable job or income source

- Clean credit history

Tips to Improve Loan Approval Chances

- Maintain a good credit score

- Submit accurate documents and income proof

- Avoid multiple loan applications in a short span

- Use your primary salary account for disbursal

Common Issues and How to Avoid Them

1. Loan Application Rejected?

- Reason: Low credit score or inaccurate documents

- Solution: Check your CIBIL score, re-upload clear documents

2. App Not Working or Crashing?

- Reason: Outdated version or device compatibility

- Solution: Update the app or reinstall

3. Not Receiving OTP?

- Solution: Check network, enable DND settings, or use another number

Is Pawram Loan App Safe and Legit?

Yes, the Pawram Loan App is registered under relevant NBFCs in India and follows RBI guidelines. It uses 256-bit encryption to protect your personal data.

Trusted By:

- Over 10 lakh+ users

- Rated 4.5+ on Google Play Store

- Collaborates with regulated NBFCs like Bajaj Finserv, KreditBee, etc.

Always read loan terms and privacy policy before proceeding.

Final Thoughts

Getting a loan from the Pawram Loan App is as easy as ordering food online. With minimal paperwork and instant approval, it’s a reliable solution during financial crunches.

So next time you’re in need, why wait? Download the Pawram Loan App and take control of your finances today.

FAQs About Pawram Loan App

1. How long does it take to get the loan amount?

Answer: Once approved, the amount is usually credited within 5 to 15 minutes.

2. What is the interest rate for loans from Pawram App?

Answer: Interest rates range from 12% to 30% p.a., depending on your credit profile.

3. Can I repay the loan early?

Answer: Yes, Pawram allows prepayment without extra charges in most cases. Check your agreement for terms.

4. What happens if I miss an EMI?

Answer: Missing EMIs can lead to penalties, reduced credit score, and recovery calls. Set auto-debit to avoid this.

5. Is there any processing fee?

Answer: Yes, a nominal processing fee (2-5%) is deducted from the loan amount before disbursal.

6. Is CIBIL score mandatory to get a loan?

Answer: While not mandatory, a good CIBIL score increases your chances and reduces interest rates.

7. Can students or unemployed individuals apply?

Answer: No, a steady income source is required to qualify for a loan.